8 Common Questions About Mortgage Loan Application

All About Mortgage Loan Applications

More likely than not, you might not have the money to pay for a house in cash; that's perfectly fine since 99% of the population is in the same situation. Mainly, this is why there are mortgages, as well as mortgage loan applications. You are probably like most people who can't afford to pay for a house in one big transaction, and this is why you need to have your mortgage loan application approved first. See the answers to the 8 common questions about mortgage loan applications below.

1Why Is Mortgage Essential?

Only a small percentage of the population can readily pay for a house in a single payment. Mortgages are thus essential, particularly for those who wish to become homeowners. People obtain money from lenders which are paid in increments, depending on the agreed upon payment schedule.

In general, a mortgage term may last from 15 to 30 years, and your house becomes yours legally after you are done paying your lender the total outstanding balance. But before you can enjoy the benefits of having a mortgage, you must first gain approval from a lender. Thus, the initial step is the loan application.

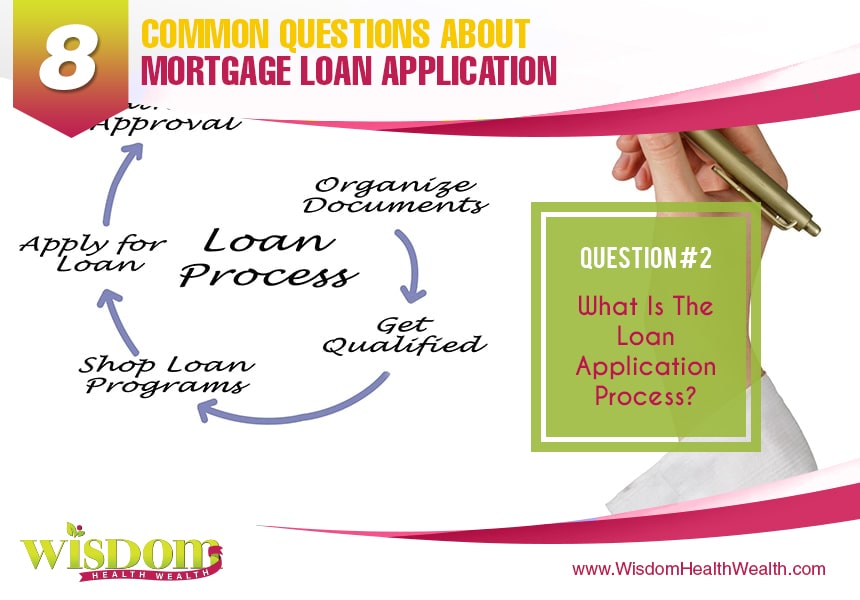

2What Is The Loan Application Process?

Before any lender approves your application, your credit history will be thoroughly evaluated to determine if you are eligible for a loan. First, you fill out a very detailed loan application form. Next, you submit your application and give the lenders some time to check and double check the information.

Once they gain an understanding of your finances and money-related practices, they will decide if you are reliable or not. Through your application form, the lenders will also determine the amount of money that they are willing to lend you. Each mortgage company will have different application forms, but the general details needed include bank accounts, balances, employment status and history, proof of income, and a record of current debts.

3What Happens After Applying For A Loan?

After submitting the application form, the lender you approached will study and verify the details that you've provided. In case your current situation fails to meet their requirements, a company representative will get in touch with you and offer you suggestions on what you can do to improve your standing like increasing your credit score, reducing debt, and others. Remember that each lender is different, so it's possible to come across one that's strict and another who is more flexible. It's not advisable to work with a bank if your financial situation leaves a lot to be desired.

4What's The Advantage Of Pre-Approval?

In case your lender is willing enough to lend you some money to buy a house, you can obtain a pre-approval letter from them. This pre-approval letter informs sellers that you have access to a certain amount of cash via your lender. Although the pre-approval proceedings can be quite tedious, the lender performs most of the review work.

Another advantage of getting pre-approval is that you can refer to a more specific price range when house hunting. Through this, you'll also gain some understanding about how much you can borrow considering your unique financial standing, which will then allow you to make better and more concrete offers on houses that you're interested in. Moreover, sellers are more willing to negotiate with buyers who've been pre-approved.

5How Do I Obtain Pre-Approval?

In general, the ball starts rolling once you find a mortgage lender who is flexible and willing to carefully review the following: your credit history, employment history, earnings, and assets. These reviews can be done in person, via email correspondence, or over the telephone. The typical lender will require the following as well: proof of employment (including documentation if you are self-employed), completed loan application form, an authorization that allows them to verify your credit, and confirmation about the source of the closing and down payment money. Although it is not a hundred percent commitment, the pre-approval illustrates that you are very serious about purchasing a house.

6What Are The Usual Borrower Criteria?

What are the characteristics that most lenders are looking for in borrowers? To increase your chances of getting a lender to approve you, you must see to it that these four factors are in good standing: capacity, credit history, capital, and collateral. Be open to them about your financial history and tackle all money-related issues, including alimony payouts, bankruptcies, and other financial problems that have a huge impact on your credit. Lenders have varying requirements, but most of them will begin with a thorough assessment of your credit. In most cases, there is more flexibility and less scrutiny during the evaluation process if your credit is in good standing.

7What Are The Four C's?

More than one percent of all home mortgages get foreclosed every year. Hence, it's vital for any lender to ensure that borrowers have the financial capacity and stability to continue paying for their house, insurance, as well as taxes that often come with purchasing a property. Hence, the initial assessment focuses on your capacity to pay your debts.

The second is an examination of your credit history, which gives lenders a clue about whether or not you pay your bills on time. As for capital, this pertains to your total cash or assets, particularly those investments that can be readily liquidated, which you can then utilize when making a down payment. Then, there is the collateral, which is the security pledge that serves as a guarantee that the lender will be getting his money back.

8How Do I Get My Loan?

After your lender decides that you are eligible for a loan, you will then be able to use the money to purchase the property that you're interested in. However, don't forget that the borrower (you) is not the only one that should be assessed when you're applying for a loan. You must also do your own research about the lenders that you are considering and choose one that is reliable and trustworthy. Don't be shy about asking questions, and you should clarify and verify everything before sharing your financial details.

About Author

Jackie Wing

GET THE FREE MAGAZINE DELIVERED STRAIGHT TO YOU: